Buying individual health insurance can feel overwhelming, especially with rising costs. However, you don’t have to settle for the first price you see. By understanding how plan structures work, you can significantly reduce your monthly outcome.

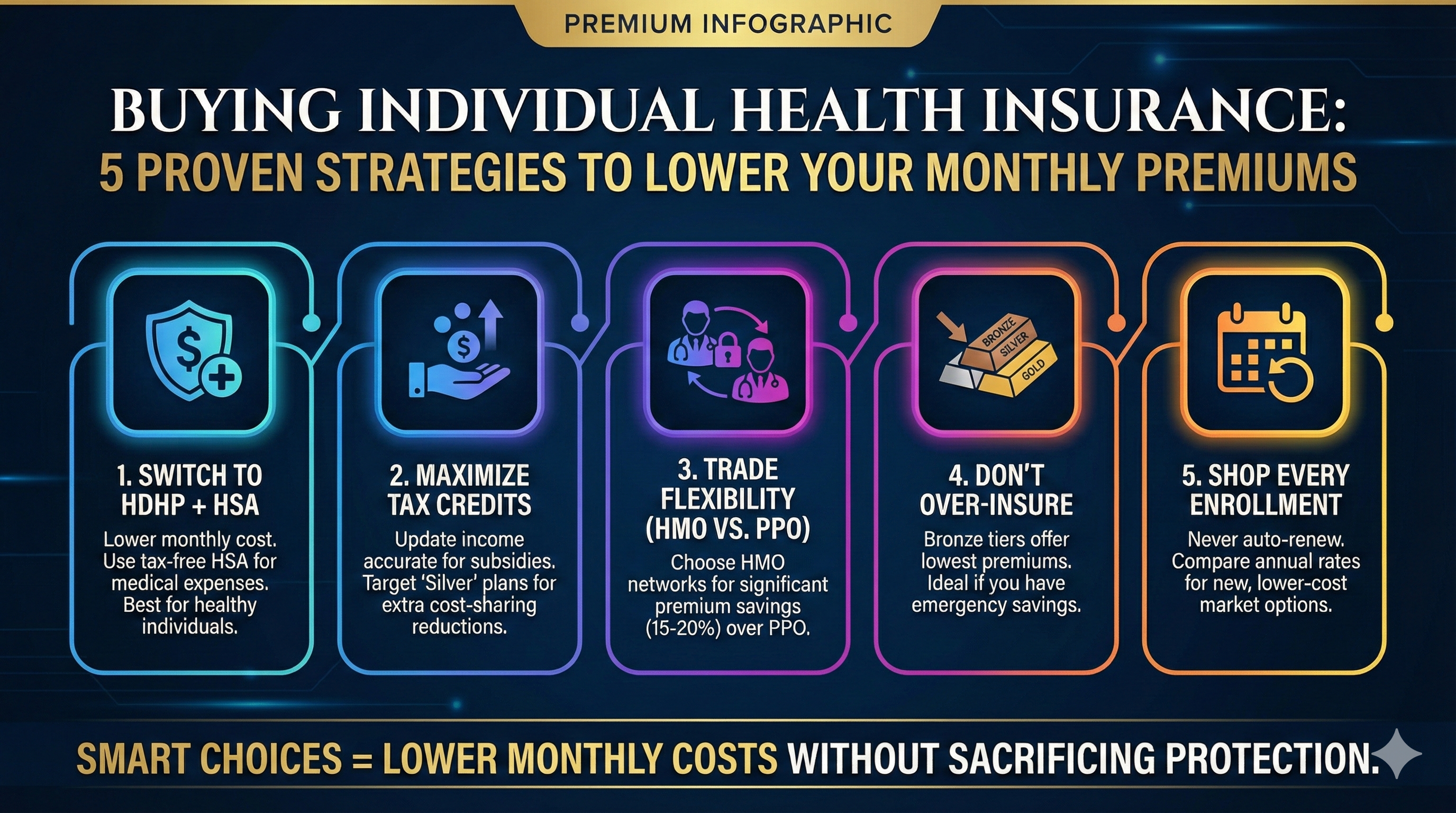

Here are 5 Proven Strategies to Lower Your Individual Health Insurance Premiums while maintaining necessary protection.

1. Switch to a High-Deductible Health Plan (HDHP) with an HSA

This is the most effective strategy for generally healthy individuals.

-

The Strategy: You choose a plan with a higher deductible (the amount you pay before insurance kicks in). In exchange, the insurance company lowers your monthly premium significantly.

-

The “Secret Weapon” (HSA): These plans usually qualify you for a Health Savings Account (HSA). You can contribute tax-free money to this account to pay for medical expenses.

-

Who It’s For: People who rarely see the doctor and want to save on fixed monthly costs.

2. Maximize Your Premium Tax Credits (Subsidies)

If you are buying through the Health Insurance Marketplace (ACA/Obamacare), you might be leaving money on the table.

-

The Strategy: Ensure your estimated income for the upcoming year is accurate. Subsidies are based on income; if you overestimate your earnings, you might pay more than necessary.

-

The “Silver” Sweet Spot: Look specifically for Silver Plans. Only Silver plans offer “Cost-Sharing Reductions” (CSR), which lower your deductible and copays if your income qualifies, giving you Gold-level value for a Silver price.

3. Trade Flexibility for Savings (HMO vs. PPO)

The type of network you choose has a massive impact on price.

-

PPO (Preferred Provider Organization): Allows you to see any doctor and go to specialists without a referral. Most Expensive.

-

HMO (Health Maintenance Organization): Requires you to stick to a specific network of doctors and usually needs a referral for specialists. Least Expensive.

-

The Strategy: If you stay in one city and don’t have complex medical needs requiring out-of-network specialists, switching to an HMO can drop your premium by 15–20%.

4. Don’t Over-Insure: Choose the Right “Metal” Tier

Plans are categorized by metals: Bronze, Silver, Gold, and Platinum.

-

The Trap: Many people buy Gold plans thinking they are “better.” They aren’t necessarily better quality care; they just cover more costs upfront.

-

The Strategy: If you are young or very healthy, a Bronze Plan usually offers the lowest monthly premium. You take on more risk if something happens, but you save thousands a year in guaranteed monthly payments.

5. Shop Around Every Open Enrollment (Don’t Auto-Renew)

Insurance companies change their rates every year. The cheapest plan this year might be the most expensive next year.

-

The Strategy: Never let your policy auto-renew without checking. New competitors often enter the market with lower introductory rates to gain customers. Spending 30 minutes comparing quotes during Open Enrollment can save you hundreds of dollars per month.

Summary Comparison

| Strategy | Lowers Monthly Cost? | Risk Factor | Best For… |

| High Deductible (HDHP) | High Savings | Higher out-of-pocket if sick | Healthy individuals |

| HMO Network | Moderate Savings | Less flexibility (network only) | People who stay local |

| Bronze Tier | High Savings | High deductible | Those with emergency savings |

| Subsidy Review | High Savings | None (Financial check) | Low-to-mid income earners |

💡 Final Tip: Check “Catastrophic” Plans

If you are under 30 or qualify for a “hardship exemption,” you can buy a Catastrophic Plan. These have very low premiums and very high deductibles. They are designed purely to protect you from financial ruin in a worst-case scenario, not for day-to-day doctor visits.

Leave a Reply